2022 tax brackets

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140. Like the Federal Income Tax New Yorks income tax allows couples filing jointly to.

Understanding Marginal Income Tax Brackets Gentz Financial Services

2022 tax brackets Thanks for visiting the tax center.

. Heres a breakdown of last years income. It is taxed at 10 which means the first 9950 of the. A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable income for the year.

The income brackets though are adjusted slightly for inflation. 14 hours agoHigher standard deduction The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. The Internal Revenue Service.

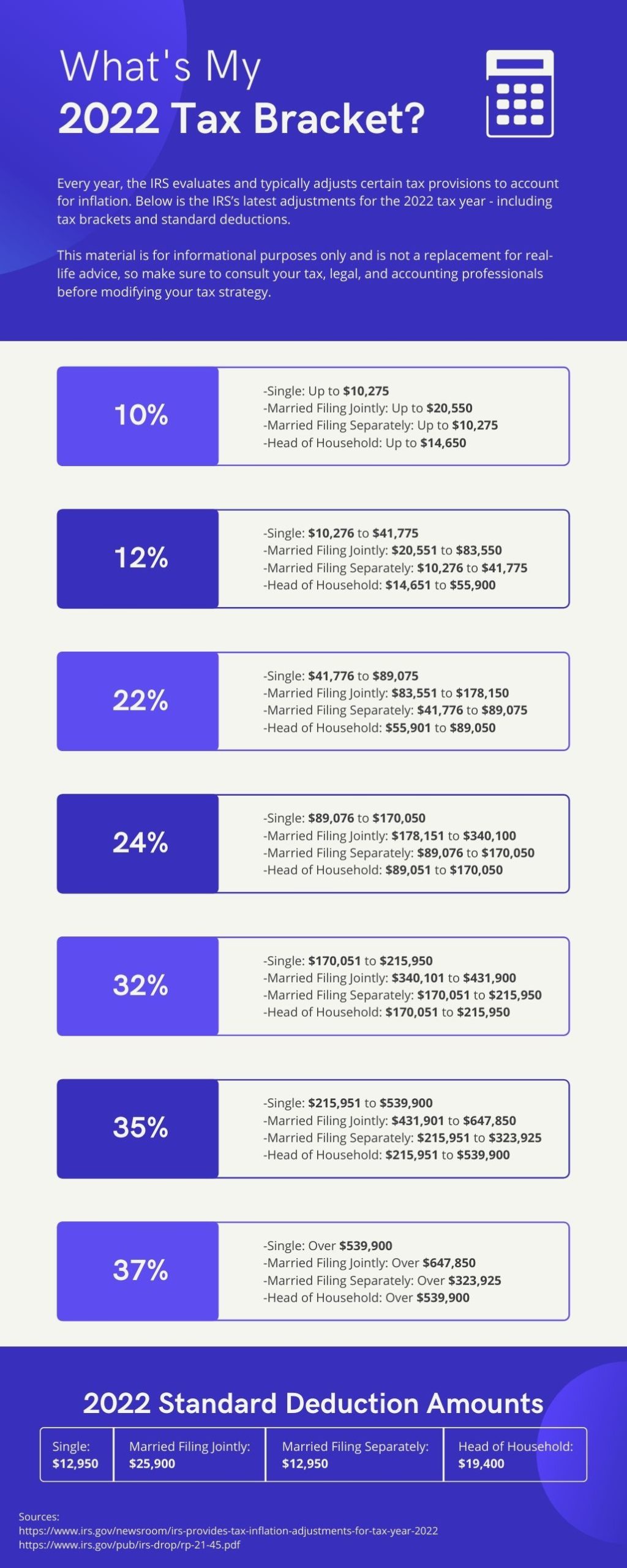

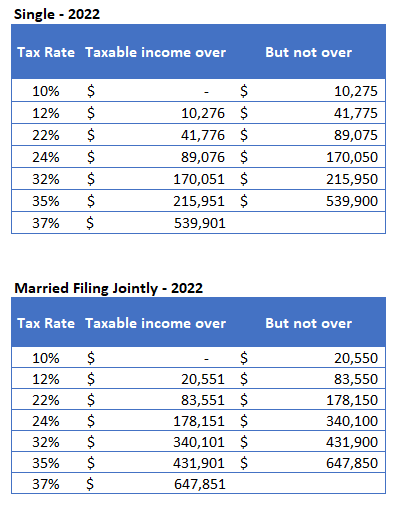

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up. Below you will find the 2022 tax rates and income brackets.

Each of the tax brackets income ranges jumped about 7 from last years numbers. The IRS has set seven tax brackets 2022 taxpayers will fall into. The tax year 2022 maximum Earned Income Tax Credit amount is 6935 for qualifying taxpayers who have three or more qualifying children up from 6728 for tax year.

10 12 22 24 32 35 and 37. The lowest tax bracket or the lowest income level is 0 to 9950. An additional 38 bump applies to filers with higher modified adjusted.

2022 Standard Deduction Amounts The standard deduction amounts will increase to 12950 for individuals and married couples filing separately 19400 for heads of. Income Tax rates and bands. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

The table shows the tax rates you pay in each band if you have a standard Personal Allowance of. There are seven federal tax brackets for the 2021 tax year. These are the rates for.

The 2022 tax brackets affect the taxes that will be filed in 2023. Your bracket depends on your taxable income and filing status. 12 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

9 hours ago2022 tax brackets for individuals. Remember these arent the amounts you file for your tax return but rather the amount of tax youre going to pay starting January 1 2022. Resident tax rates 202122 The above rates do not include the Medicare levy of 2.

The seven tax rates remain unchanged while the income limits have been adjusted for inflation. New York collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Tax brackets for long-term capital gains investments held for more than one year are 15 and 20.

The agency says that the Earned Income. However as they are every year the 2022 tax brackets were adjusted to. Resident tax rates 202223 The above rates do not include the Medicare levy of 2.

10 12 22 24 32 35 and 37. The current tax year is from 6 April 2022 to 5 April 2023. There are still seven tax rates in effect for the 2022 tax year.

Here are the 2022 Federal tax brackets. 9 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. There are seven federal income tax rates in 2022.

To access your tax forms please log in to My accounts General information. The top marginal income tax rate. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year.

What S My 2022 Tax Bracket Green Retirement Inc

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

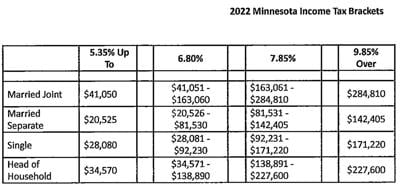

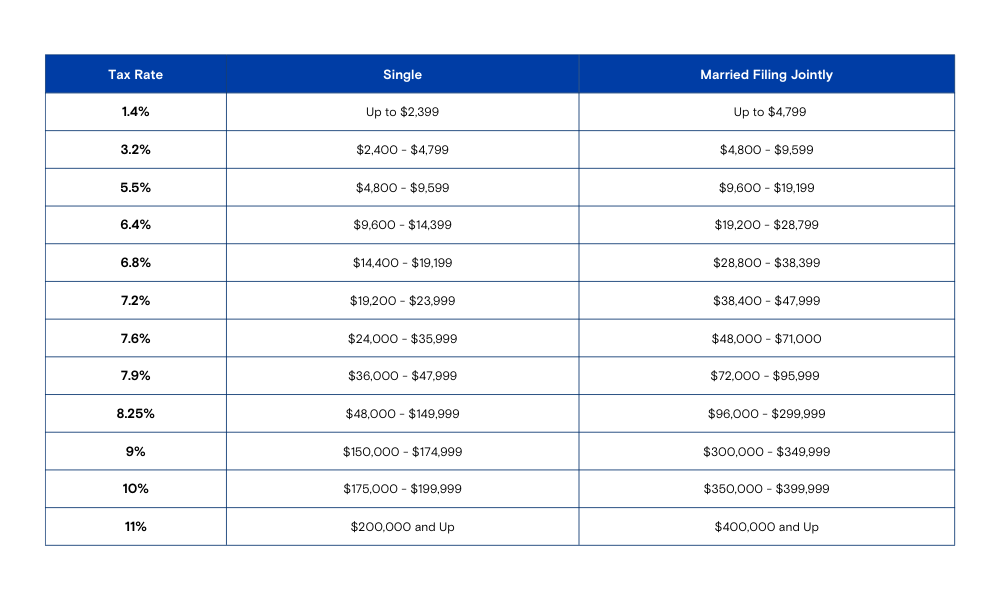

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

What S My 2022 Tax Bracket Infographic Delphi Advisers Llc

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

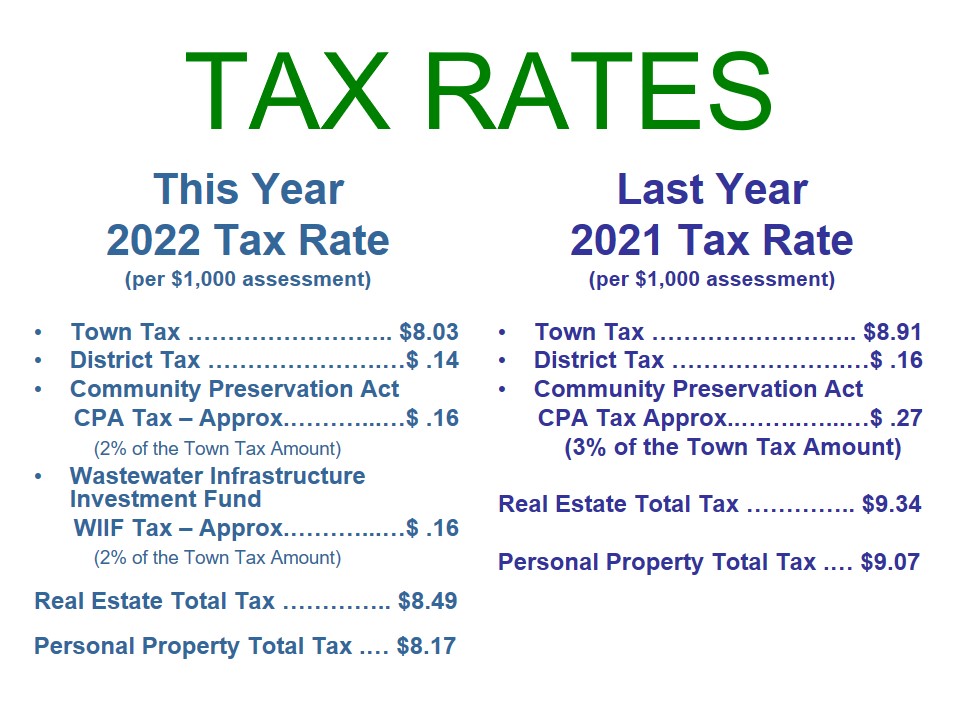

Fiscal Year 2022 Tax Rate Town Of Mashpee Ma

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

2022 Tax Brackets Darrow Wealth Management

2021 2022 Tax Brackets And Federal Income Tax Rates

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

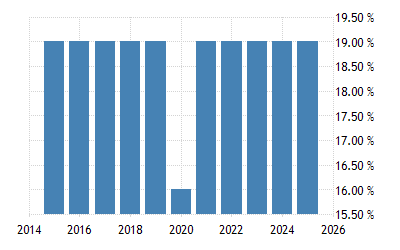

Germany Sales Tax Rate Vat 2022 Data 2023 Forecast 2000 2021 Historical

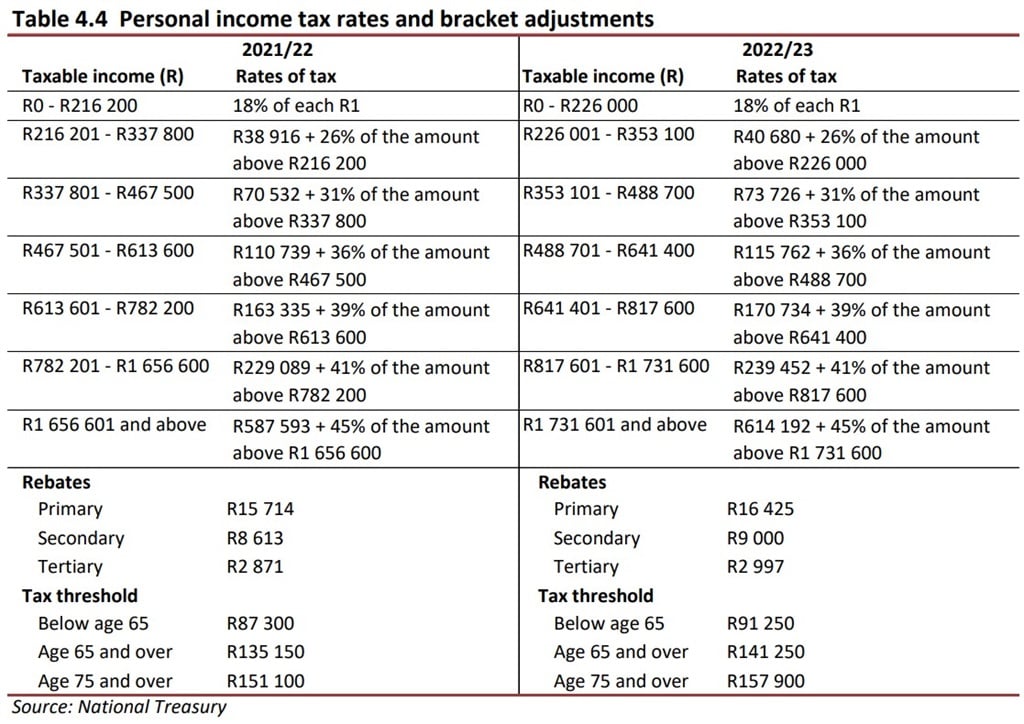

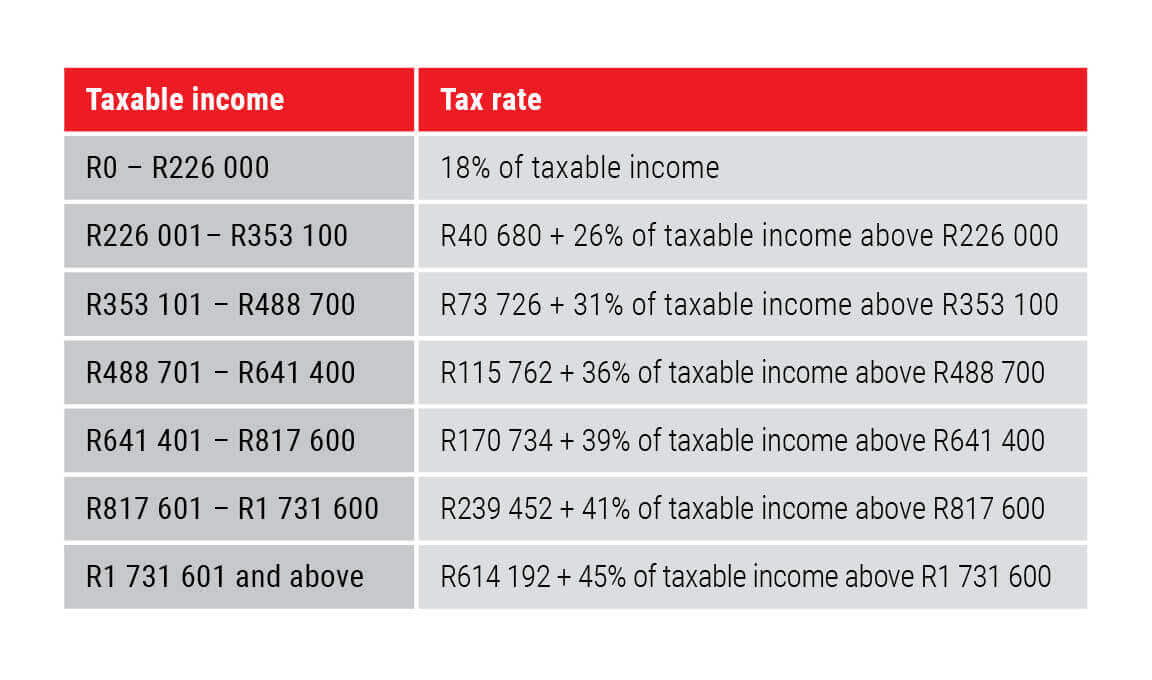

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Allan Gray 2022 Budget Speech Update

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

Analyzing Biden S New American Families Plan Tax Proposal